Before you take action, talk about other streams for raising the money

- In case your number functions, a 401(k) advance payment financing possess advantagespare exactly what a month-to-month home loan perform cost which have and you may instead mortgage insurance rates, after that calculate exactly how much you would need to repay so you’re able to your 401(k) monthly if you decided to use from it. Just remember that , mortgage insurance coverage is not tax deductible, very all you dedicate to it is a loss of profits. A great 401(k) loan is actually money you will be borrowing off on your own, and that means you dont get rid of anything.

- Property try a good investment you to generally speaking appreciates over the years, as well as the collateral your generate inside it are a valuable asset. After you eventually sell it, you usually can also be pouch a good amount of the appreciated really worth taxation free. In case it is a good investment that produces feel for your requirements, arranging an educated finance package would be an element of the equation.

- Home loan insurance policies isn’t https://paydayloanalabama.com/stewartville/ really cheaper. It is advisable to end using it, nevertheless must consider your power to pay-off the newest 401(k) prior to utilizing it while the a simple solution.

One which just do so, mention other avenues to own improving the money

- Borrowing from the bank off a 401(k) minimises your old-age discounts, temporarily and possibly forever. you tend to pay-off that which you borrowed contained in this five years, the borrowed funds doesn’t expand tax-free during those times. In addition might not have enough money to carry on making typical 401(k) efforts, a loss of profits which is compounded for folks who forgo searching complimentary efforts you to companies usually offer.

- Because most employers no more render pension preparations, tax-advantaged retirement account including 401(k)s are the main method we help save because of their older many years. Reducing the individuals discounts you will suggest less money readily available after you retire.

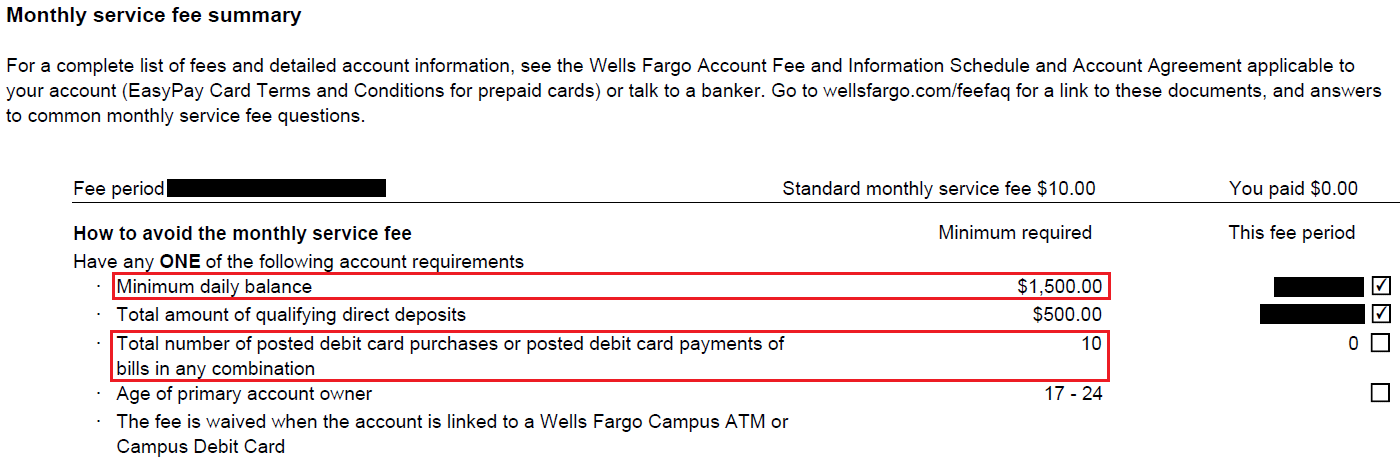

- Lenders check income, expenditures and expenses once you get financing. Paying down your own 401(k) try a cost and will also be included in calculating what size a mortgage you really can afford.

- For many who get off your job, possibly voluntarily otherwise due to a layoff, possible necessary to pay-off everything lent within a couple months. Isn’t it time regarding? Perform the loan curb your job alternatives?

- Are you pretty sure you can generate repayments promptly? Failing to proceed with the fees plan often move your loan so you’re able to an early on withdrawal while younger than 59 ?, and you might deal with a 10% penalty together with taxes. Money withdrawn out of an excellent 401(k) are taxed as money.

The bottom line

No matter if a beneficial 401(k) loan is actually a choice for leading to your own down payment, it’s just not the only choice. You can wait to make a purchase, building a property-buying funds external your retirement account, or you might examine mortgages and you may home loan-guidelines software that do not wanted PMI to own down payments out of less than simply 20%.

You can use the most suitable choice predicated on your research otherwise recommendations of a monetary thought counselor. For those who have a different Advancing years Account (IRA) you might withdraw up to $10,100 for a deposit without paying an earlier detachment penalty, nevertheless the money is taxed since income. If you have good Roth IRA, you don’t have to pay fees principal your withdraw.

If you are using new IRA means, you could thought rolling more funds from their 401(k) to the a keen IRA next withdrawing the latest $ten,000. The money might be taxed but zero punishment was charged. To help you be considered, just be a first-day house consumer, definition you cannot has lived-in a home your owned having going back a couple of years.

Finally, you could potentially withdraw financing right from your own 401(k) because of an adversity shipments for folks who meet the requirements underneath the plan’s laws and regulations. Even though you can take the new shipment, you will be charged a good 10% punishment and ought to pay taxation on the detachment. You will additionally be unable to sign up to your bank account for six months after the shipping.